Make minutes count and avoid churn for Banking & Financial Services customers

Financial institutions invest in a digital experience for many reasons, but perhaps none are more important than attracting and retaining satisfied customers.

Retail and corporate customers may already have access to a well-designed web portal as part of digital onboarding. Some customers may already be onboarded and authorized for transactions within a day. Simple account service requests are processed in what seems like real time. However, more commonly, there is a major disconnect between the digital experience institutions want customers to have and the experience they actually have, especially once the customer needs move beyond the digital front-end into the operational back-end, where technology complexity and manual work are mired down with friction and slowness.

What most financial institutions overlook is that by focusing only on front-end channels, customers’ experiences across the board are not improving. “Digital” is often a veneer masking the reality of slow onboarding, irksome customer touchpoints, and manual business-as-usual inefficiency.

We have worked with hundreds of customer lifecycle management (CLM) leaders and keep hearing a similar concern: The longer onboarding takes, the longer to service requests, the more often customers have to submit (or worst, resubmit) information, the higher likelihood that they will move to a competitor. As many as 40% of corporate customers reporting dissatisfaction with their bank and approximately 15% annual retail customer churn, the costs of getting it wrong are high.1,2 Corporate banks annually lose 10–15% of revenue from customer attrition, according to a BCG study.3 Customer retention challenges are exacerbated as fintech and other banks promise a new way to meet banking needs. Often these companies offer simpler access to financial services and are not saddled with the same complexity and manual work as incumbent banks.

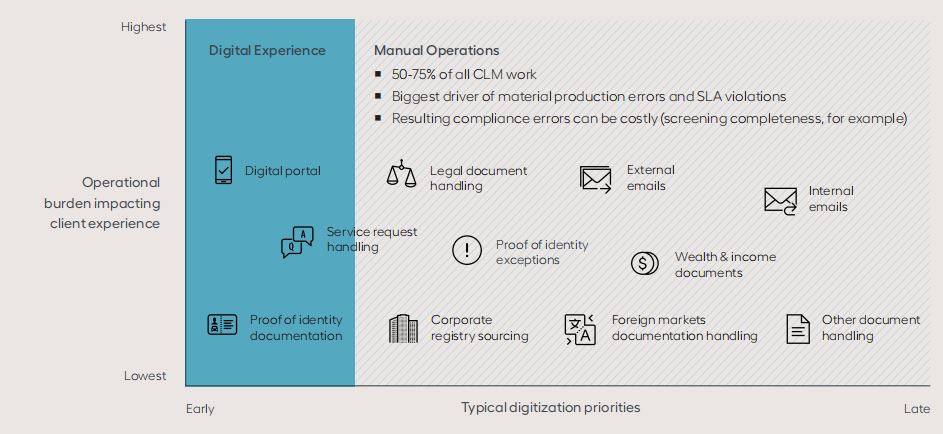

Many financial institutions have digitized customer-facing interfaces and intake processes, but the vast majority of document processing and communication is all still done manually. What are the consequences of relying on manual operations in these areas? Customer churn, missed revenue opportunities, growing operational costs, and errors that can draw negative regulatory attention, to start. Our experience shows that, on average, internal communication (business line to operations, operations to compliance, quality control to business line, etc.) and document handling operations add 7–15 days of onboarding time per corporate customer and 1–3 days per retail customer. Each of these days has a measurable cost of forgone revenue because the customer is not fully onboarded nor permitted to transact. Some customers will even drop out of the onboarding process entirely due to this sluggishness, and those lost customers may never return. For legacy customers, manual operations erode trust and may lead them to hold back from additional business opportunities with the institution. Manual operations also have high labor costs. Research shows that mid-sized institutions can spend upwards of $50 million annually on CLM operations, and larger banks easily spend more than $500 million annually.

Some real-world examples related to manual operations in communication and document handling5 :

- The business-line CEO of an American bank identified that repetitive requests for information and the bank’s slow responses to routine requests were leading drivers of corporate customer dissatisfaction.

- An American bank launched a web portal for its corporate customers, to speed up onboarding. The platform accepts documents, but verification of document permissibility is done manually. Due to a backlog, some customers were asked, weeks later, to re-submit documentation. The customer perspective was that they waited weeks just to start onboarding.

- An American fintech found that each request- to-customer touchpoint beyond the initial application increased dropout by more than 25%.

- A European bank is on a multi-year journey to digitize its front-end customer experience and internal operations. The bank manually reviews hundreds of thousands of scanned and electronic documents as part of onboarding and KYC refresh. The lead regulator repeatedly found that operations staff routinely failed to identify all related parties within documentation, which means incomplete screening. To regulators, this is a major miss.

How are financial institutions today helping to match the reality of internal operations to customers’ digital expectations?

CLM leaders are introducing automation to customer communication and document handling, so they can execute previously slow and manual tasks in nearly real time. Customers’ service request emails are categorized and routed immediately as they land in a bank’s inbox. Internal communication is processed rapidly, to avoid self-generated backlogs. Customer-onboarding document packages are automatically scanned and checked to confirm that no documents are missing or expired. Data is extracted automatically from those documents and sent into systems or records, screening engines, risk-rating systems, etc.

Financial institutions will always have competing priorities and options for how to improve the customer experience. Providing customers with a front-end web application, digital phone app, smart ATMs, or other channels to facilitate onboarding no longer counts as innovation: It is now a minimum expectation. No other innovation can do more to improve the customer experience than using automation to decrease time-to-onboard, repetitive touchpoints, and long service times. These steps also lower operational costs and improve capacity for managing anti–money laundering, KYC, and sanctions risk, without the need to wait for longer term strategic operating models or new CLM technologies.

When is the right time to automate manual communication and document-handling operations?

Whenever a financial institution wants to gain a competitive advantage! No matter what stage of the digital (or CLM) journey a financial institution is in, the need to handle communication and documentation without negatively impacting the customer experience is critically important. Financial institutions wait to automate the manual work in Figure 1 above until after the roll-out of a global onboarding vendor solution is complete or as part of a “2.0” wave of digital innovation. However, customers will not wait and instead find another preferred institution.

Digital CLM transformations are complex, and many take years to reach a target state. During the interim, a “digital experience disconnect” can emerge. Financial institutions expect that customers will see rapid improvement in their experiences with the bank. A disconnect occurs when this expectation is met with front-end application development delays, stability concerns, internal system consolidation challenges, re-prioritization of budget to unexpected regulatory requirements, or management of technical debt. All of these can distract from the goal of improving the experience for all customers, not just the simplest cases. Automation of communications and document handling is proving to be the fastest and most effective way to help expectations and reality meet as fast as possible. For customers, no digital transformation can be complete without it.