Serving over $1 trillion in advisory & brokerage assets, LPL Financial is the leading provider to independent financial advisors in the United States. The company’s strategic automation goals were to increase efficiency, support growth, and help deliver great experiences for financial advisors and their clients.

Challenge

LPL Financial supports more than 19,000 advisors nationwide who serve more than 6 million American investors, who open hundreds of new accounts every day. The LPL team that focuses on service, trad- ing and operations, which facilitates these account openings, often receives over 3,000 documents daily — which need to be validated against 20 different business rules. Both LPL and all the advisors who conduct their business on its platform demand that this work be com- pleted accurately and in a timely fashion, despite this being a complex task with high routine volume, as well as periodic spikes.

Solution

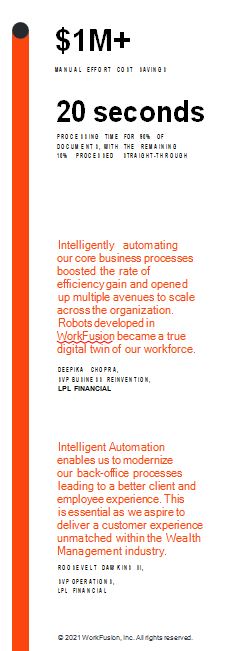

By automating how account application forms are processed through its operational platform, LPL achieved significant efficiency gains. LPL deployed Intelligent Automation Cloud to streamline several critical document-handling tasks, thus saving 80% of overall processing time. According to LPL metrics, 10% of documents are processed straight- through, with no need for human attention. The remaining documents require very minimal intervention, and are handled in an average of 20 seconds each. Automation thus reduces chances for errors while ensuring achievement of business SLA targets. Automation also handles spikes in volume with ease, enabling the firm to provide consistent service and support with the same resources, creating a savings of more than $1 million.

Impact

- Real-time processing & approvals

- Faster account openings

- Increased employee satisfaction

- Improved accuracy